Difference between FCFF and FCFE

Free Cash Flow for the Firm (FCFF) and Free Cash Flow for Equity (FCFE) are two different terms that define a business’ cash flow. These are common terms used in business and are always referred to when discussing a particular company’s cash flow and performance. Many people often confuse FCFF and FCFE as being relatively the same but there is a significant difference between them. Free cash flow for the firm is financial performance measurement that basically calculates cash that is being generated after deducting all expenses, taxes and changes in net working capital. Free cash flow for equity is the amount that is distributed among any business’ shareholders after making deductions on expenses, changes in net working capital and debt repayment. To calculate FCFF, the formula is FCFF = Operating cash flow – expenses – taxes – changes in net working capital – changes in investments. To calculate FCFE, the formula is FCFE = Net income – net capital expenses – change in net working capital + new debt – debt repayments.

Instructions

-

1

FCFF

Free cash flow for the firm is basically financial performance measurement of a particular company that basically looks at the amount of cash generated after making deductions of all types of expenses, changes in net working capital, taxes and changes in investment. After making deductions from all types of outflows, this amount is distributed to company’s stockholders. Free cash flow for the firm needs to be calculated on time as it will give brief details about company’s profitability and financial stability. The negative and positive values are important when you calculate a firm’s free cash flow. If FCFF amount comes out to be a plus or positive value, it means that your company did well in a specific calendar year. If the FCFF value comes in negative then it means your company is not doing well.

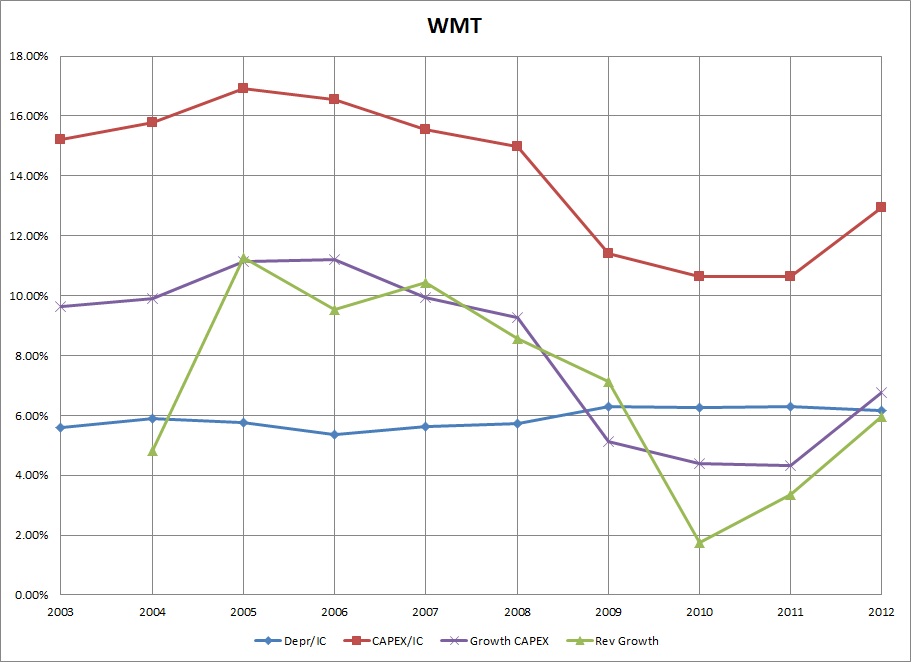

- Image Courtesy: mylesrennie.weebly.com

-

2

FCFE

Free cash flow for equity is the amount that is distributed among any business’ shareholders after making deductions on changes in net working capital, expenses and debt repayment. The value of FCFE will help you determine the overall value of a firm. In placing dividends, it is also very important to calculate FCFE with precision.

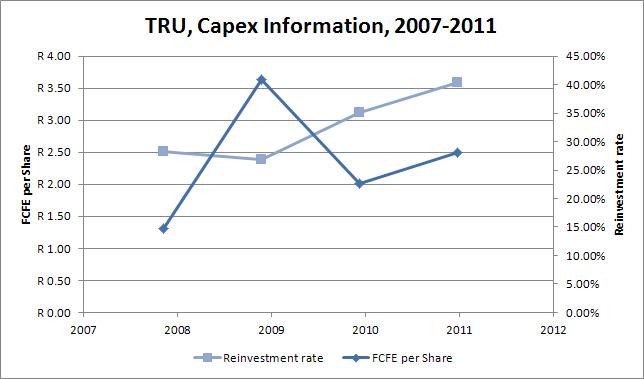

- Image Courtesy: oldschoolvalue.com