How to Incorporate a Business

Instructions

-

1

Decide if your business will benefit

One of the main reasons companies go for incorporation is because of the benefits attached with it. It helps to limit your personal liability and make it easier for your business to connect with others. You will have your incorporation outlive you, take your company public, transfer ownership among members of the corporation. Depending on the kind of business you deal with, incorporating might be right for you. -

2

Appoint a board of directors

As the CEO of the company, you choose your board of directors, and have their names and contact information designated on your incorporation paperwork. The directors will therefore act with the best interest of the company in mind; they also help to protect the investments of shareholders and appoint the company's officers. -

3

Decide between filing as a C corporation and an S corporation

C corporations are individually taxable; they file a corporate tax return and pay taxes at the corporate level. They also have multiple classes of stock, such as preferred and common.

S corporations on the other hand, are available to companies that intend on having fewer than 100 share holders. They file an information federal return, but do not pay tax at the corporate level. It is however only available for one class of stock.

Your preference can be based on your number of shareholders. -

4

Hire a corporate lawyer

You can make mistakes if you try to do this on your own, as the laws and paperwork are quite complicated. The best thing to do is to hire an attorney to avoid filling wrong information. -

5

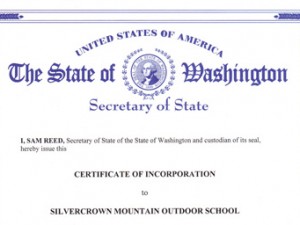

Contact the secretary of state's office in your state

After following the steps above, the next step is to get in touch with the secretary of state's office to handle all matters related to incorporation. The secretary should be able to direct you specifically to the proper forms that you are to fill. -

6

Acquire the articles of incorporation

The articles of incorporation are made up of several documents, of which each has its own fee and required information. To get these documents, you need to contact the secretary of state's office to know the ones applicable to your state. Thereafter, you can met with your lawyer and fill them out with the right info. -

7

Pay the incorporation fees

While you file your documents at the secretary of state's office, you'll have to pay the fees attached to some of the forms; usually not more than $100 for each. Nit all forms have attached fee, but for the concerned ones, you'll have to pay in order to progress. -

8

File a statement of information form

This form is usually filed after the initial filing of the articles. It includes fairly basic information about the corporation, like: the names and contact details of corporate directors, members of the board, vacancies/change in leadership, mailing and street address of the corporation. However, not all states require this form, so you'll have to check the secretary of state's website to be sure if your state requires it or not. -

9

Register your corporation with the United States Internal Revenue Service (IRS)

After registering your corporation with the state, the next step is to register with the IRS. C corporations will file IRS Form 1120, while S corporations will file Form 1120S; depending on your category. -

10

Designate a registered agent if you live elsewhere

If your corporation business is held in a country away from where you reside, you will need to designate a local registered agent to accept official paperwork on behalf of your business. You could ask your lawyer to recommend one for you, and you are most likely to pay the registered agent annually.