How To Avoid Penalties for a Return of IRA Contributions

Individual Retirement Agreements or Accounts (IRAs) are the supply of funds that you can generate to earn money for retirement savings. There are a number of IRAs like Roth, SEP, Simple and Traditional IRAs. On the other hand, just individual taxpayers can create a Roth and Traditional IRAs. You can give all of your income, keeping in mind it stays within the maximum limit and the money is tax detectable depending on a few factors.

Moreover, Simple and SEP IRAs are set up by employers only. People can also utilise their accounts as useful tax management techniques. However, there are several rules and regulations that need to be followed when managing and handling your IRA. There are a few ways to avoid penalties for a return of IRA contributions.

Instructions

-

1

Make the IRA contributions accurate

Correct your IRA contributions. There is a particular cap number to your respective IRAs. You will need to make this amount right in time in order to avoid paying taxes for the exceeded amount and the interest creates by the surplus amount. As a result, remember to fix this problem before you are charged with a penalty that is too much for you to pay.

Furthermore, you can use the IRA account without paying any penalties. It can be used to pay the tuition fee for a college or a university program. It is also justified to buy a house for the very first time. Employees who are near retirement and have a functional retirement plan can also put their money from IRA account to the other one without paying any taxes.

- Image courtesy: pmbg.net

-

2

Penalties

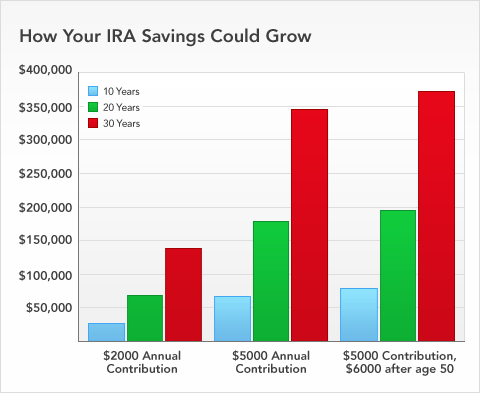

Early distribution penalty is when you are younger than 59 and a half years old. In this case, you will be charged tax for each IRA transaction. Nevertheless, there are a few exemptions who don’t have to pay the tax, but still they will have to notify the IRA trustee or custodian. If you do not report this to the authorities, you will have to pay additional taxes.

- Image courtesy: learningcenter.statefarm.com

-

3

Exceeding maximum contributions

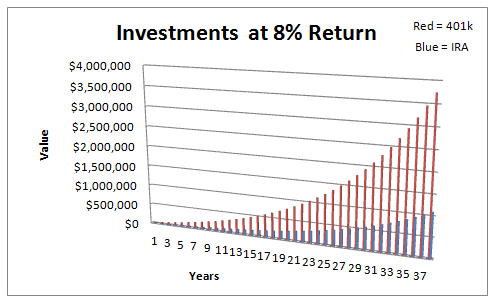

There is also penalty for excess contributions. Each year, there is a set amount on your IRA contributions. This is to ensure that people do not go around the rules and misuse the tax-saving methods of the IRA. The excess amount that is surplus is known as the excess contribution. Excess contribution and the interest on it should be removed from the account to avoid facing penalties.

- Image courtesy: iravs401kcentral.com