How to Get a Tax ID Verification Letter

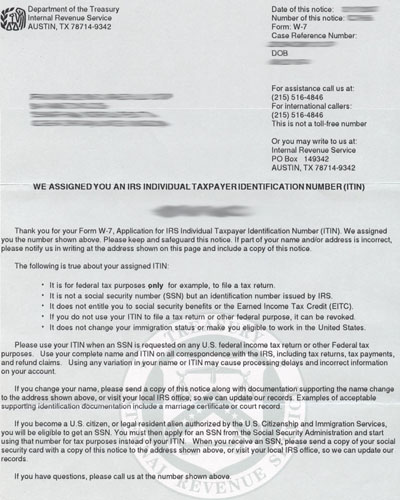

The Tax Identification Number or the EIN (Employer Identification Number) is assigned by the Internal Revenue Service to all businesses for various purposes, such as opening accounts with banks, filing for taxes etc. However, if you lose it, then only the IRS can provide you a Tax ID Verification letter. The process is relatively straight forward, and is mandatory for the business to continue its activities.

Instructions

-

1

Business Structure

Verify the type of business structure you are referring to. The IRS will need you to specify the information under three broad structures – proprietorship, partnership or corporation- in order to process your request. -

2

Online

Log on to the IRS website (IRS.gov) to start the application process. Here you can receive all information on how to begin. You will need the form SS-4 - Application for an Employer Identification Number. Fill the details related to your business type if you wish to fill the form online rather than printing it first to fill it out the old-fashioned way.

The IRS will quickly verify the details, the basic being your Social Security number and various tax identification details. Once all details have been reviewed, you can print the Tax ID verification letter. You can also have it mailed to you if you don’t have access to a printer. In any case, you will need the Adobe Acrobat Reader installed on your computer to access the PDF files. -

3

Toll free number

You can further contact the IRS department during their defined office hours, set between 7am to 10pm, on their toll free number. Here again you will need to provide your business information along with other details such as address and contact information. The customer service representative will then verify the information and will direct you accordingly. For instance, if you changed your business number, than you will need to fill Form 8822. The IRS representative will then validate your request before assigning you a verification letter. The process can take up to a month and your verification letter will be mailed to you.