How to Pay Employees with QuickBooks

A number of times businesses require to pay their employees with cash rather than issuing a paper pay check. There can be some reasons that the business wants to or needs to do this. The organization might be having cash flow problems, or paying employees from cash is simple to do so. On the other hand, the employee might not have a bank account. Cashing a pay check is hard and too costly, and direct deposit is not on the cards. Therefore, there are several ways to pay them with the help of QuickBooks.

Instructions

-

1

Cash payment is not a good payment method

Companies should try not to give their employees cash for work carried out. There needs to be some kind of paper trail to prove in what manner the worker received the funds, when the employee received the money, how the monthly pay was calculated and how employment taxes were deducted from the pay; net pay vs. gross pay.

If you hand over the cash, then all of the above mentioned issues could arise in the event that the worker challenges the pay, or in the event of work comp audit or employment tax. You should pay the employees in a way that you protect the business from prospective problems. -

2

Payroll service

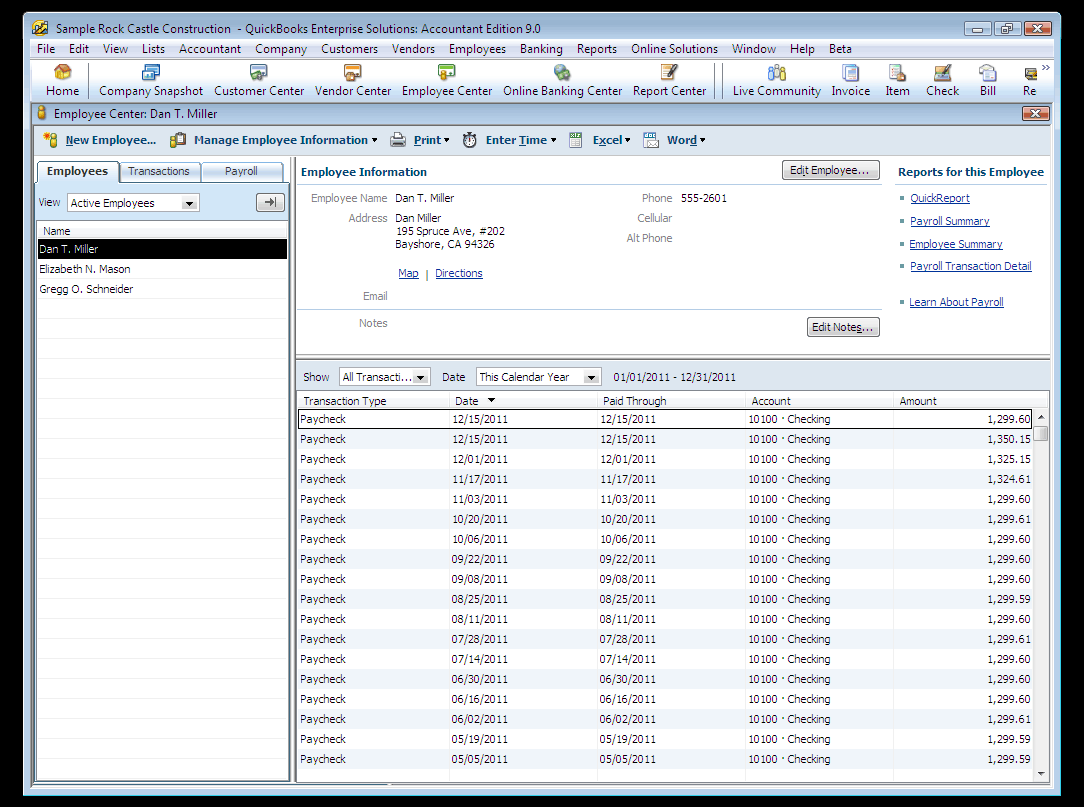

The business should be operated with some kind of payroll service. QuickBooks should be enabled to carry out payroll, or you can also choose an outside service to perform the task. Importantly, the processing of the salaries does not matter as long as payroll taxes and others are computed correctly.

Produce a pay check in the normal way, using the checking account to draw cash from, or a special checking account for payroll, if you possess one. Also have the employees approve the checks that he or she is signing it over to the employer. -

3

Pay cash

Pay the workers cash. The amount must match the sum on the checks. This is very important as the cash given must match the check amounts. If the amounts are not the same, the reconciling will get very hard. Take the checks and deposit them back to the checking account.

Make sure you do not void them in the software. Voiding them will have the exact net effect on the bank balance, the accounting software will not be able to compute the gross pay and payroll taxes correctly if they are voided.