How to Calculate Depreciation Expense

Depreciation is the wear and tear of the fixed asset that is caused by its usage over the course of years. Every year, the fixed asset is depreciated because it is used in the process of creation of goods to the delivery. It is crucial for the firm to report the depreciation amount in order to depict the true value of the fixed asset in the statement of financial position. Every year, the depreciation of fixed assets is part of the expenses category in the profit and loss account and subtracted from the historical price of the fixed asset. However, the question over here is how to calculate the amount of depreciation. It can never be calculated to perfection. Therefore, just an estimate is used every year which is based on two most influential methods used all across the world for the calculation of depreciation.

Instructions

-

1

The two methods that are used to calculate the amount of depreciation are:

Straight-Line method

Reducing Balance method

It is the duty of the management to decide which method will be used for the calculation of the depreciation of which asset. -

2

Straight-Line Method:

For trucks and other delivery vehicles, the straight line method is used in most of the industries. So, the calculation of depreciation with the help of the Straight-Line method is depicted below:

You need to have the following data for the calculation of the amount of depreciation using the straight-line method.

Historic cost of the asset/Purchasing price

Number of years of the useful life of the asset

Scrap Value of the asset -

3

Formula: (Historic cost – Scrap Value)/(Useful Life)

-

4

Consider the following example: (all figures in dollars)

Historic cost of a truck = 1000

Useful life = 5 years

Scrap Value = 100

Straight-Line depreciation = (1000 -100)/5 => 180/year

The amount of 180 is the yearly depreciation of the truck that will be accounted for at the end of the first year of the truck use. -

5

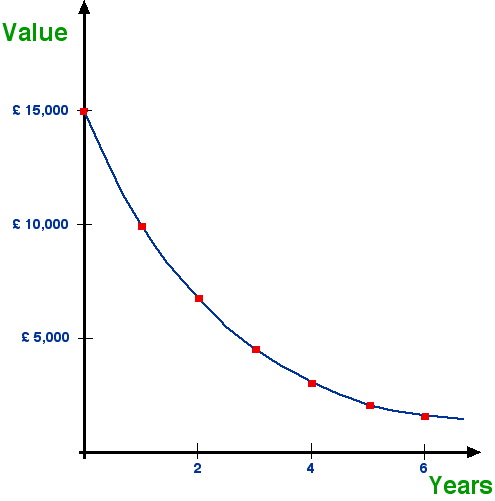

Reducing Balance:

Formula:

Depreciation/year = (Historic cost – accumulated depreciation)*depreciation percentage -

6

Consider the same example as above. A particular depreciation percentage per year is allotted to the asset in this case. We will use 15% in our example.

Depreciation by reducing balance is calculated in a following manner:

Year 1 depreciation: 1000*15% => 150

Year 2 depreciation: (1000-150)*15% => 127.5

Year 3 depreciation: (1000-150-127.5)*15% => 108

And so on.