How to Write a Financial Statement Analysis

When deciding whether to invest in a company, your research should include a review and analysis of its financial statement. The financial statement of a company is a key indicator of its financial health, and can help you make a better informed decision in terms of investing your hard earned money.

Instructions

-

1

Obtain the financial statements of the company in review. You can get these through the Securities and Exchange Commission’s EDGAR database, if you are interested in information related to a publicly traded company.

However, for businesses which are privately owned, you will need to look at other ways to gather the necessary financial information as they are not obligated by any commission. Ideally, attain information for the past five years, which will essentially include the balance sheet and income statement. However, larger companies will also prepare cash flow and shareholders' equity statements. -

2

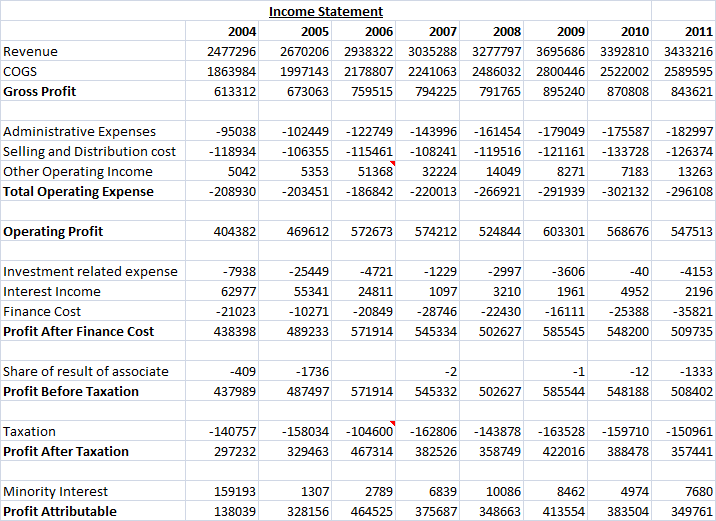

Now analyse the balance sheet and income statements. The former provides a snap shot of the company’s finances at a specific point in time. Comparing respective years will tell you the assets a company has up its sleeves, and how efficiently it has used them to manage their activities. Moreover, you will be able to analyse any risk factors, and the potential for growth.

As for the income statement, it will depict the amount of revenue it has been able to generate and expenses it has incurred. Comparisons will help investors gauge the overall performance of the company and whether it has been able to make constant money or not. This will be determined by the rise or fall in expenses relative to revenue. -

3

Shareholders' equity is another way of determining the overall stock activities a company has pursued, and what purposes the money has been used for. Similarly, cash flow statements give a fair reflection of the cash related activities of company.

-

4

In order to analyze closely, one can further compute the ratios of interest. These will include liquidity ratios such as current, cash, quick, profitability ratios such as profit margin, return on assets, return on equity etc, debt ratios, operating performance ratios and other investment ratios. These ratios form an integral part of the financial statements and help potential investors decide whether buying the stocks of a particular company is a viable investment.