Difference between Currency Swap and FX Swap

Currency swap and FX swap are two different terms but many believe that both serve the same purpose. However research shows that both are quite different terms and not related to each other. If two parties are agreed to exchange some specific amount of different currencies, it will be called currency swap. On the other hand, FX swap is an agreement between two parties regarding specific currency which they can sell or buy at specific rate. In FX swap, both parties also have freedom to buy or sell different currencies at a specific rate or at a later date.

Instructions

-

1

Currency swap

In currency swap, two different parties can exchange specific amount of currencies. Basically it is an agreement that gives both parties a legal security in this risky business. In currency swap, one party swaps a series of payments in foreign currency while another party swaps another currency. In economics, currency swap payments have two different terms as well. One is called principal payments of a loan and another is loan for an equal amount of different currency. You can give many examples to explain currency swap. For instance, a US based firm is dealing its businesses in UK while a UK company is doing businesses in US. Both companies need dollars and pounds for a specific deal. UK based company will buy dollars while US based company will buy pounds. Though both companies are buying different currencies, but in actual terms, both are lending and borrowing currency of each others country. The US based company will pay the debt for UK based company while the UK based company will pay the debt for US based company. The exchange rate or interest rate (fixed or floating) however, effects on currency swap.

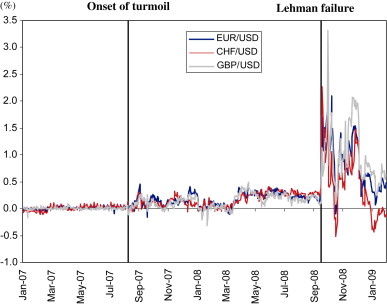

- Image Courtesy: sciencedirect.com

-

2

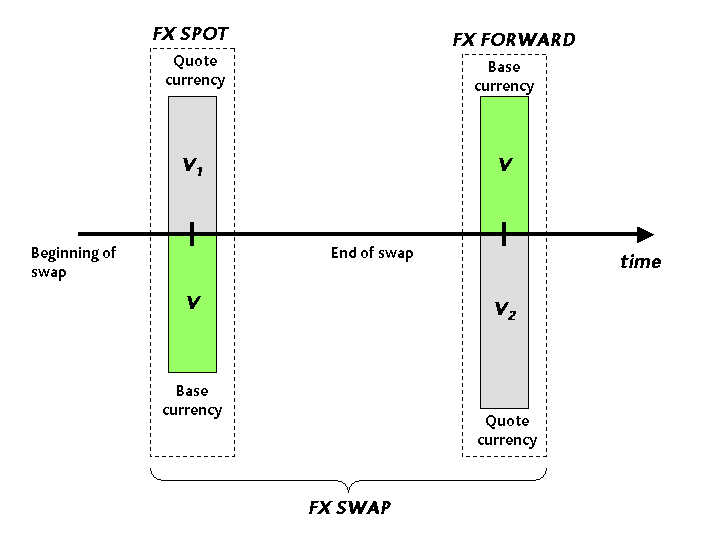

FX swap

FX swap is also an agreement between two parties in which both sell and buy different currency at a given rate with respect to date. However, in FX swap, some leniency regarding date is still there as the exchange can be made through on a lower rate. There are two parts in FX swap. Its slightly complex than currency swap. In FX swap, you can buy and sell a specific currency at an agreed rate while you have another option in FX swap that you can even sell or buy different currencies at a forward rate. Although it might sound confusing but there is a real difference when using a FX swap. If you are need more help then you might want to talk to a currency broker as he or she will be in an excellent position to guide you better.

- Image Courtesy: trust.ru