Difference between Ordinary and Qualified Dividends

When you invest in a company, you are offered shares which can be sold for capital gains. If you choose to retain your investment, you are entitled to get dividends, which is a form of income on the amount you have injected in the business. While the above theory related to dividend is understandable to most, the fact of the matter is that you are also bound to pay taxes on your vested interest. Therefore, it is important to understand the types of dividends options at your disposal, which in turn will have a direct impact on the amount of profits you make.

Typically, all dividends fall in the ordinary dividend category. You simply buy shares of the company and when the company declares profits, you are entitled to get a chunk of it. However, in order to fall in the qualified dividend category, you may be required to meet certain criteria.

Firstly, qualified dividends can only be paid by a US corporation or a qualified foreign company. The time frame of owning the stock also differs. For common stockholders, they must retain their investment for at least 60 of the 121-day period before the previous dividends were declared. For preferred stockholders, this period rises up to 90 days during a 181-day period.

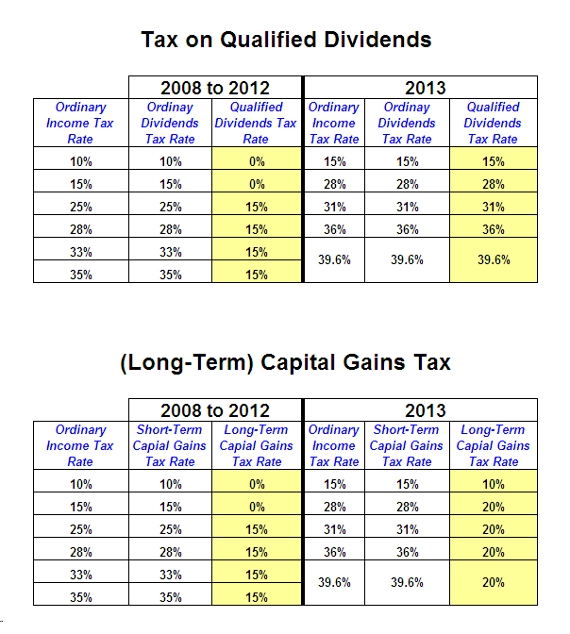

The biggest advantage for qualified dividend holders comes in the tax consideration. You will be taxed, depending at the capital gains rate, which is the extra amount you have received upon selling. This capital gains rate will fall in the range of 0 to 15%, which will further depend on the income bracket you fall into.

For instance, if your tax bracket is below 25 percent, then you will be paying no taxes. If your income bracket is above or equal to 25 percent, than you will be taxed 15 %. For ordinary dividends, you will be paying ordinary income tax, the amount of which is usually greater than you pay on qualified dividends.

Instructions

-

1

Ordinary dividends

It is the share of the company’s profit which is divided among the shareholders. All dividends are ordinary, unless clearly specified, and are considered as a form of income, to which income tax is applied.

Image courtesy: people.opposingviews.com

-

2

Qualified dividend

They are a subcategory of ordinary dividends which are usually taxed at the lower capital gains tax rate. They differ from ordinary dividends in time frame, sources and reporting.

Image courtesy: boomerstakestock.com