Difference between EPF and PPF

EPF and PPF are two different terms which are basically meant for providing individuals with some kind of savings. The savings culture is very old while societies grow towards more development of individuals, various kinds of plans came for the well being of citizens. EPF stands for Employer Provident Fund and PPF stands for Public Provident Fund. Employer benefit fund has to do with salaried employees. A portion of their salary is put in to a separate account which is added to and managed by the company. Upon retirement an individual will get access to this money which can be quite considerable depending on your salary and the length of time you worked for that particular organisation. On the other hand, anyone unemployed or employed, housewives and children can benefit from a Public Provident Fund. Various nationalised banks offer to open a Public Provident Fund account.

Instructions

-

1

EPF

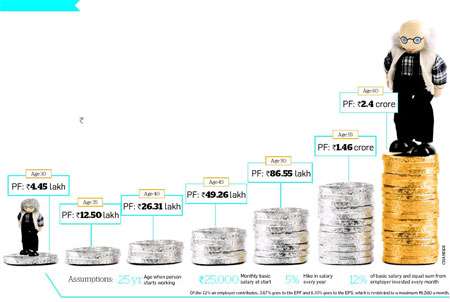

Employer Provident Fund is for salaried persons. It is entirely for the benefit of the employee and gives a return on an increased rate. Along with this benefit, Employer Provident Fund has also other plus points including short or long term loans. These loans can be taken in case of marriage or if anyone has to build a house. Though you need to produce documents to avail any sort of loan but overall this facility alone can certainly give relief to employees during difficult times. This benefit of Employer Provident Fund ends as soon as you change your job. Another benefit of EPF is that your employer has the freedom to transfer Employer Benefit Funds to another company until retirement. Overall expert economists say that looking at the broad picture, the Employer Provident Fund has more benefits in the end as it involves increased interest rates.

- Image Courtesy: articles.economictimes.indiatimes.com

-

2

PPF

PPF stands for Public Provident Fund and it applies to children, housewives and anyone regardless of employment. Any individual can open a Public Provident Fund account with a nationalised bank or even the post office. PPF account is also another method of saving but unlike EPF, it gives you returns on a specific interest rate depending on your overall savings. If someone has a Public Provident Fund account in a bank, he or she can take a loan up to 50 percent of their savings in the fourth year. The maturity period of a Public Provident Fund is different in many countries. It can be 20 years as this is considered the ideal time for maturity while in some countries 15 years are also acceptable.

- Image Courtesy: tutyhub.com