How to Teach Your Child About Investing

Some time while your child is still young you should take the time to teach them the importance of money and how investing their money the right way will benefit them. Investing can be a tedious subject if not presented to your child in a way that will seem interesting to them.

To begin with, don’t expect a young child to have any interest in investing their money anywhere that isn’t into the candy store. Try to teach your child the value of money so that as they grow in their teens you can show them what investing their money might mean to them for their future.

You likely give your child an allowance for doing chores around the house. This is the place for you to begin to teach your child about the values of money and how investing it properly will make it grow. First teach your child the value of investing their money into a savings account. This is a simple first step. You will have to teach your child that a savings account is actually the first step in investing their hard earned allowance even if it does not appear that way to them. Teach them that by putting their money in an account that generates them interest that the interest is the reward of investing in the bank.

You also need to teach your child the value of money and what it takes to be able to pay the bills and live a life based on your income. Teach the child that if they work hard and learn useful ways of investing their money they will be preparing for a more successful life. You don’t want your child to be frivolous with their money, but you also don’t you want to teach them to be miserly.

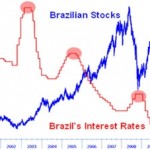

As your child enters their teen years its time to teach them how they can be investing their money and watching it grow. Investing in the stock market can be a tricky thing and many people lose their money when investing in stocks they know little about. Teach your child that if this is their preference for future investing that researching the stocks that capture their imagination is the only way to make informed decisions. People can make money investing in stocks, but your child has to know that stocks can go down just as easily as they rise.

You also will need to teach your teenager that there are other options on what they can do with their money. Teach them about mutual funds, which are the process by which many people jointly invest in stocks and bonds. This is potentially a better way of investing for your child, as it is much less risky. The money does not sit just with one stock and is a shared risk. You need to teach your teenager that even putting their money into something you hope will make them money may generate profits or it may fail. Teach them to be self-sufficient so that if the investment fails they have other money to fall back on.