Difference between Liability and Equity

Liability and equity are terms of great importance to the owners of any business. Whenever someone chooses to start a business, he or she is faced with the dilemma of keeping business separate from personal belongings.

However, an individual will need to invest some of his or her own resources into the business and hope to make a return on it. This part of the accounting cycle will be referred to as equity. Moreover, as his or her own money will not usually suffice for the long terms goals of the business, the owner may look up on the services of other individuals, who can invest in the company in various capacities. That will in turn create a liability for the business, which will be paid back at some point in time.

Therefore liability and equity are monies owed by the business to its investors and owners respectively. Liability however, will eventually be returned to its investors somehow or the other. Equity, on the other hand, may or may not be taken out by the owner. In case of bankruptcy, an owner may be held liable for the debts incurred by the business. If business resources (assets) are not sufficient to pay off the liabilities, the owners must give up their share i.e. Equity they hold in the business.

Another difference between the two notions is that liabilities are the money which a business is obliged to pay to external creditors. Equity is the internal portion, which a business owes to its owners.

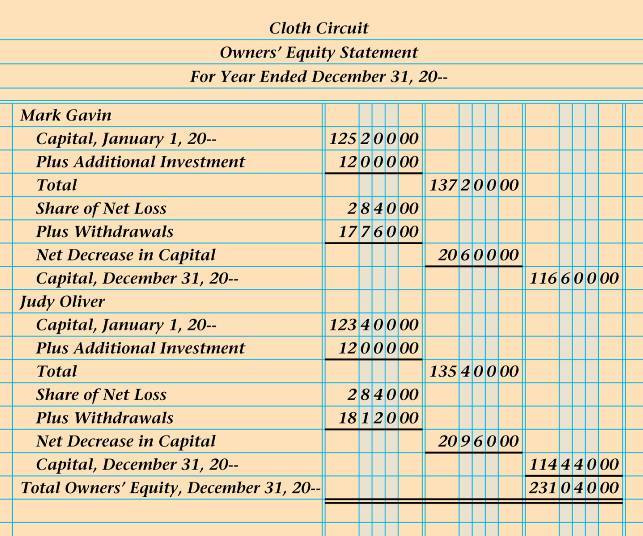

Liabilities are made up of current (less than a year) and long term sections, while equity is composed of three sections, namely paid-in-capital, drawings and retained earnings. A liability may be a contra asset, whose regular entry is a debit one as oppose to credit.

Equity is not considered a liability, even though it is recorded on the right-hand-side of the accounting equation which implies that assets must equal total liabilities plus shareholder’s equity.

Instructions

-

1

Liability

It is a debt or responsibility owed by a company during the running of its business activities, the payments of which must be settled over time, in accordance with the law.

Image courtesy: bowmanandassoc.com

-

2

Equity

It is referred to as the capital or money invested or funds contributed by an individual in a corporation or business.

Image courtesy: dkerby.com