Difference Between SWIFT Code and Routing Numbers

Have you ever transferred money from one place to another?

If yes, you must be familiar with the terms of Swift Code and Routing Numbers.

The main purpose of these two codes is to identify the bank. A lot of financial institutions and companies generally use these codes to know the details of one particular bank. In simple words, these codes can be declared as fingerprint of a bank in the financial world.

Although the main purpose is identical, there are some differences between them. For example, routing numbers are always 9 digits in length. On the other hand, a swift code consists of 8-11 alphanumeric characters. Besides their structures, there are multiple differences; the biggest one being their use.

Routing Numbers are used only for financial transactions within United States of America (USA), while the use of Swift Codes is for the international transfers. It means that if you are interested in transferring money from USA to another country, you always need a swift code.

Routing Codes are used for more than one purpose. Apart from using them for the local transactions, one can use it for the electronic payment processing. It can be done through ACH, bill pays and paper drafts. Swift codes, on the other hand are only used for transferring money from one country to another.

Instructions

-

1

Routing Numbers

A 9-digit figure, routing number is made for transaction within United States of America. You can easily find this number at bottom the cheque. This code helps in identifying the bank from where the cheque is drawn.

In early days, routing number’s sole purpose was to sort, bundle and ship cheques back to the issuers. However, since the implementation of Check 21 in America, such numbers have been in use for processing of paper drafts.

One always needs a routing number, if he/she is interested in direct deposits and withdrawals. Another use of routing numbers is bill payment by the Automated Clearing House.

Image Courtesy: bremer.com

-

2

Swift Code

Swift code is also used to identify a financial institution; it is used only for international transactions. This code ensures that the money reaches the exact location and is a little lengthy than a routing number.

For instance, 021000021 is the routing number of a Chase account, while its swift code is CHASUS33. A swift code is made of different small codes.

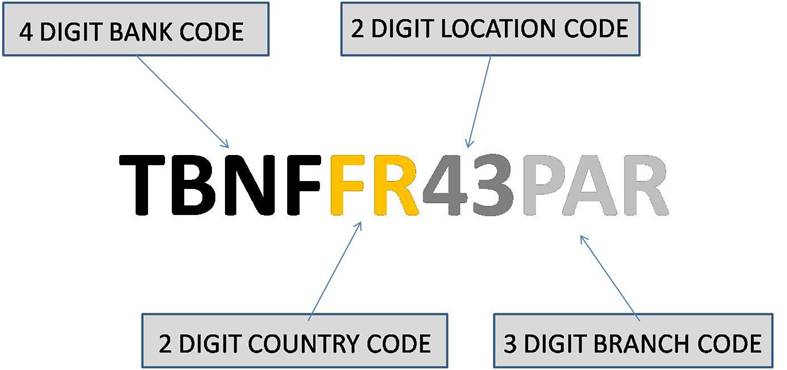

For example, the four letters are used for the bank code, and the next two for the country code. The next two and three are respectively used for the location and branch code.

Image Courtesy: support.commbank.com.au