How Do You Define Working Capital

All businesses rely on working capital to meet unexpected expenses and other operational costs. It basically refers to the liquid assets a company has at its disposal to meet its obligations. Working capital is generally computed by taking into account current assets and current liabilities, with the final value termed as working capital surplus or deficit.

A company may have various amounts of assets but profitability or essentially, growth may be affected if it does not have the ability to readily covert these assets into cash. For a working capital to be positive, a business must be able to continue its operations with sufficient liquid funds at hand.

As you start up a business, working capital is essential for sustaining purposes. Most businesses often get shut down in the early years due to not having enough working capital at their disposal.

Instructions

-

1

In order to build and maintain working capital, companies have various sources. Net-income is the most important, and is commonly referred to as the profits a company makes from its operational activities. Other sources include long term loans which ease pressure on short-term obligations, selling assets, funds contributed by the owners and proceeds from sale of stocks.

-

2

In order to efficiently manage working company, one needs to access the financial statements and analyse the cash flow streams. If liabilities are greater than your assets, you need to work on ways to cut down on your costs. Ideally you must have more cash than you are paying for your products.

-

3

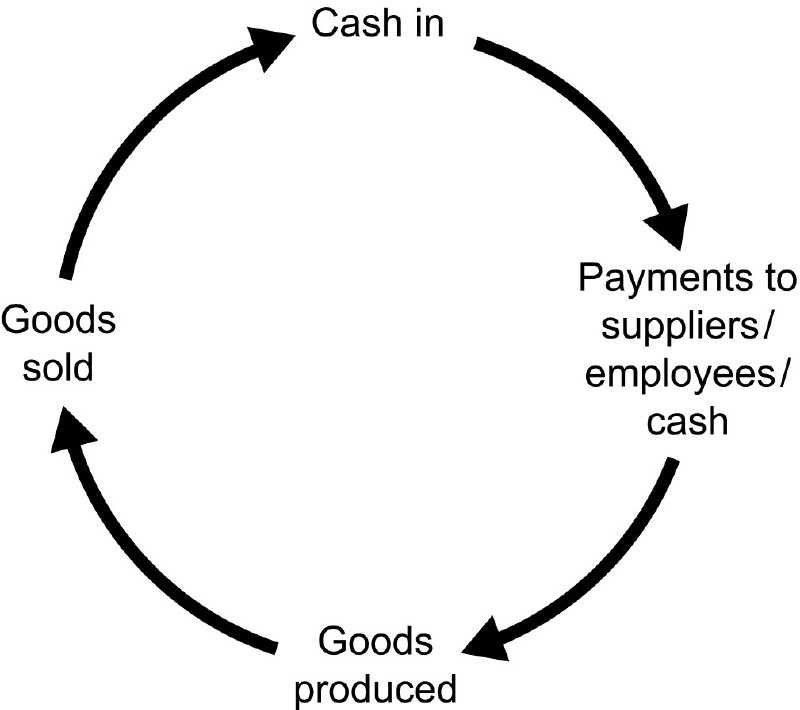

Essentially look at the selling patterns, or the supply chain element of the business. Efficient management will ensure that the company’s products are produced quickly, and distributed in a timely manner. That ensures that the final product is instantly within the reach of your customers, who then make timely payments, resulting in positive capital management.

-

4

The Days-Sales Outstanding is a perfect indicator for companies to gauge the length of the cash cycle. It basically tells you the time frame, in days, i.e. how long your cash has been tied up. This will be calculated by dividing the receivables with your total annual sales before multiplying the value with the number of days. A higher value is unsatisfactory as it will indicate that the company has a long time span when it comes to meeting its short-term obligations.