How To Avoid a Credit Card Services Scam

Fraud unfortunately has become a part and parcel of our everyday life. There is always someone who is trying to con us through some scheme somewhere. Most of us have been at some point in time been at the receiving end of such rough deals.

When it comes to credit cards, there is no shortage of scam scenarios. It could be a scam from a merchant or a store employee trying to use your information to get some goods of his/her own. It can be in shape of stealing data through ATM’s as well.

However, one scam which may not be as common but does take place is the credit card services scam. There are many fake companies out there who try to make money by either offering them services that they actually cannot offer or by plainly lying altogether and making a dash to the door once they have gotten your money. This thing can be avoided by being a little more careful when such a situation comes your way.

Instructions

-

1

Avoid Unknown Companies

You may get offers from companies that are unknown. Although there is no reason why these companies can’t be clean, you can never know for certain. In such a situation, it is best to avoid such a company as you can be scammed.

Image Courtesy: pakalertpress.com

-

2

Check the Credibility

When you get an offer via phone or mail for a credit card, do not go crazy and say yes. Take your time and search about the company and if it is a legitimate service provider. You can check on the internet as there will be good or bad feedback available about the service. You will have to be patient in the process as sometimes the desired results are not on the first page. If there is nothing online, you may want to avoid such a company as it can be a scam.

Image Courtesy: scottsvab.blogspot.com

-

3

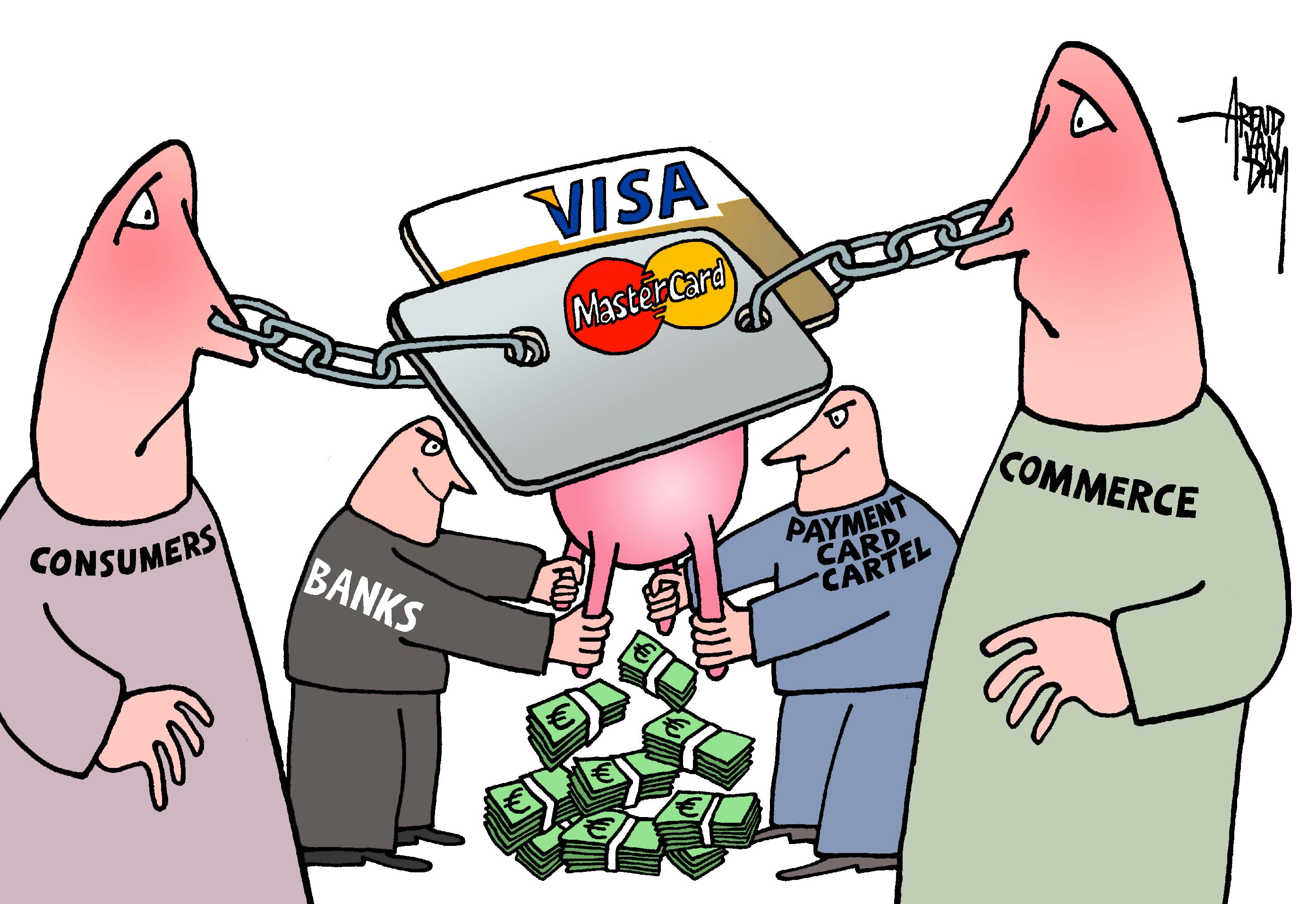

Look for Charges

Some of these offers may ask you to submit a certain amount of money via your bank account or existing credit cards. This is a big red flag. Most legitimate credit card companies will not ask you for any kind of setup fees and if there is any such fee, it will be deducted generally on a monthly basis and will be added to your bill. An upfront charge is an indication that it can be a scam.

Image Courtesy: rippoffreport.wordpress.com

-

4

Check with You Credit Union

You can always check with your credit union to make sure that you are not being scammed. They generally have information about companies that are running a legitimate service and those who are trying to scam consumers.

Image Courtesy: aossimarketing.ie