How to Calculate the Present Value of a Loan

Trying to find out the stream of cash flow requires one of the primary concepts of time value which is often used in financial theory. You can take the help of the internet as there are plenty of calculators that have been made available for the general public to make such calculations. The hurdles that one encounters while performing these calculations are identifying the correct variables that have to be used. The present value of the loan, interest rate and number of payment periods are used to calculate the total repayment amount of a loan. For you to know calculate the present value of the loan, you should be aware of the future value, interest rate and the number of periods. If for instance you have a $10,000 bond that is to be paid within five years with a six percent interest. The bond is the representation of the loan that you have made to the government. To determine the present value of a loan of such potential is a fairly simple task.

Instructions

-

1

Start off with analyzing the interest rate paid on the loan. For those of you, who find it difficult to perform such a task, seek the help of your loan adviser or else you can take a look at the documents and get a little know-how of how it is done.

-

2

After determining the interest rate paid on your loan you must come up with a number that shows the payment periods. The payment periods should be of the time you have the loan. Lets exemplify by saying that loan is for five years with an 8 percent rate.

-

3

Next in line is the future value. You will need to find out the future value in order to come up with a present value. The future value includes the total amount of the loan that has to be paid off with the interest rate. By looking at the loan documents or the loan schedule you will get a fairly good idea and all the required details. In case you do not find the paper work to be of much help, it is advised to seek the refuge of your loan adviser or the loan service provider. Let’s suppose the future value of the loan is $18,000.

-

4

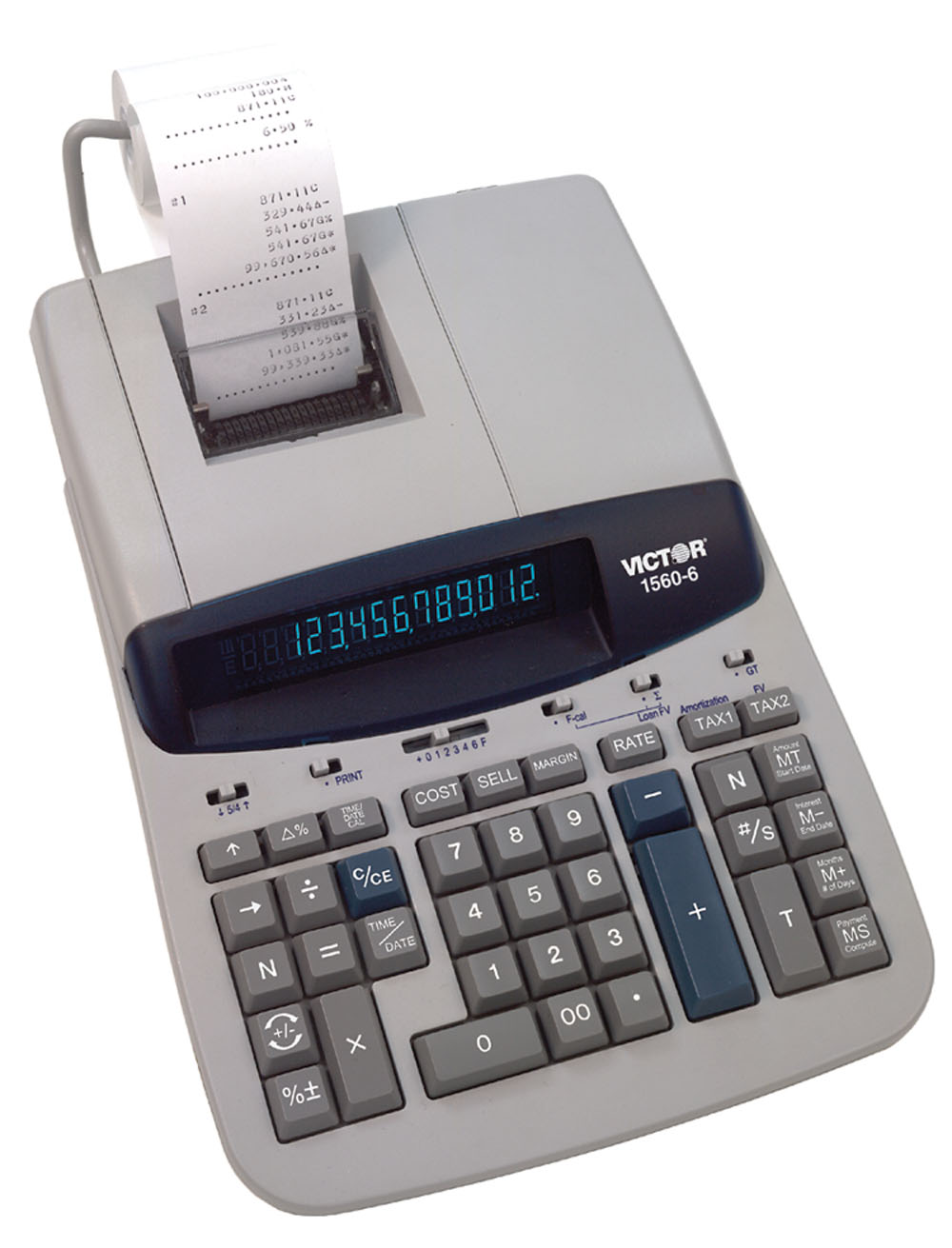

With all the information at hand, you need to register these variables into a present value calculator. Finding the calculator is not a problem as there are plenty available on the internet. You can determine the present value of the loan with the help of the calculator. You also have the option of using a financial calculator and the present value of an approximate number. By inputting the variable the present value of the loan comes out to be $12,250.50.