How to Get Unemployment Benefits in California

The state of California has one of the highest unemployment rates in the United States. While the situation has shown improvement over the past 12 months, the unemployment rate still stands at 9.8 %, just better than the states of Nevada and Rhode Island.

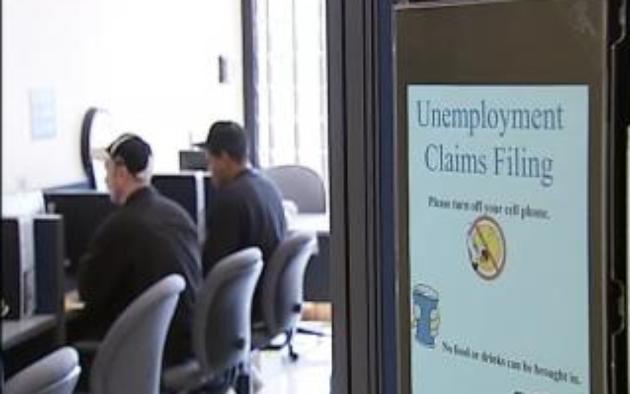

There are many people in California who need unemployment benefits, as provided by the California Employment Development Department. The EDD reviews your case, and distributes the benefits according to the laws of the state.

Instructions

-

1

You will need to fill an unemployment compensation claim form by logging on to the California Employment Development Department website – edd.ca.gov. Under the “Need Employment Benefits?” title, look for “Apply for Unemployment”. Apart from the online procedure, you can further apply for benefits via mail, telephone, or visiting in person.

-

2

The step above will initiate your claim, and further allow the state to review your case for eligibility. You will need to provide basic information such as Social Security number, permanent address, your employment history of the previous two years, along with the details of your current unemployment situation. You will be stating with reasoning as to what prompted you to leave your job. Make sure to provide contact information as well.

-

3

All information will be reviewed by the EDD which will verify your information. The basic element to check for is the reasons of unemployment. If it was your own fault, then you are not entitled to receive benefits. The factors may vary – disability, family crisis etc – but may not be a result of your own inability to perform the task. The information will be further verified by contacting your previous employer and any ambiguity can result in dismissal of your claim.

-

4

After the department has reviewed your case, contact them and set a date for collection. The amount is calculated by taking into account the average weekly salary you have earned in the highest earning quarter. Moreover, you can earn up to a maximum $450 for every week, and 26 weeks of benefits in a given year. Generally you will have to wait for three weeks before you will be entitled to benefits.