How to Prepare a Financial Statement

Financial statements are official records of a company, business, or entity, pertaining to its financial activities. These help creditors and all concerned parties to gauge the performance of a company in a given year. Financial statements give a structured snap shot of the company’s position, and further include a detailed analysis of its future goals.

As the company grows, or goes public, these statements become more and more complex, with management discussing and explaining all of its financial policies in the notes section, which basically describes each item in detail.

Instructions

-

1

Preparing Balance Sheet

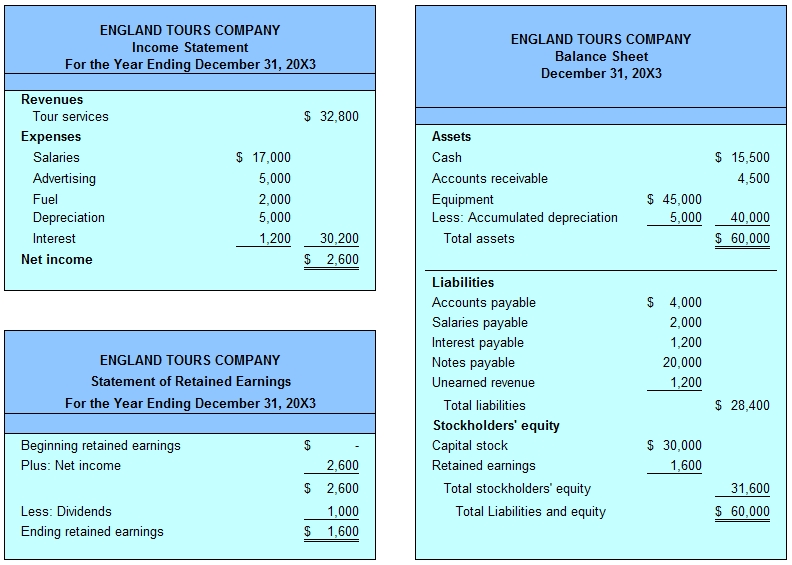

A Balance Sheet reports all the assets, liabilities and shareholder equity of a company in a given accounting cycle. Assets will be the resources owned by the company, and consumed or used in the production process. They will include cash, accounts receivable, land, equipment etc, along with intangible assets such as patents. Liabilities will be the commitments a company needs to realize, and will include taxes, loan payments, accounts payables.

The difference between assets and liabilities will help determine the equity of the company. The equity can be either retained by the company, utilized for expansion purposes, or simply used to pay out its shareholders in the form of dividends. -

2

Income Statement

The income statement, or Profit and loss Statement, will inform us about the revenue streams of a company in a given point in time. It will include information on the company’s income, expenses and net income or loss. Income will be calculated from the sale of a product or service offered by the company before subtracting all expenses such as advertising, debt expenses, salaries, rent, taxes, and any dividends paid out. Comparisons of the profit and loss statements help assess the success of the company. -

3

Cash Flow Statement

A cash flow statement is concerned with the cash a company has at a given point in time, not usually at the end of the accounting cycle. It takes into account the changes in balance sheet and income and further breaks it into operating, investing and financing activities. It is a useful tool for determining the short term ability of a company to pay its debts. There are two methods of preparing cash flow statements – direct and indirect. The former directly subtracts cash payments from cash receipts, while the latter deducts non-cash items from net income.