How to Prepare a Profit & Loss Statement

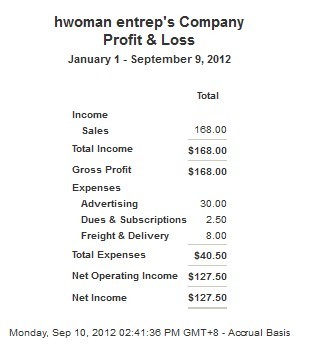

A profit & Loss Statement, or simply an income statement, displays the revenues and expenses a company has incurred during a particular accounting cycle. The main purpose of preparing the statement is to show investors and owners the financial standing of the company – whether it has made or lost money. It is a bit different from a balance sheet, as it indicates a period of time. Generally there are two methods of creating a P&L statement, a simpler approach (revenues – expenses) and multiple approaches, which incorporate every step in detail.

Instructions

-

1

At the top of the sheet, or software, which you have used to prepare the Profit and Loss statement, enter the name of the company, the date and the year of the statement. This will usually be the closing date of the year.

For simplicity, the basic formula of calculating the profit and loss statement simply incorporates revenues and expenses. Subtracting the two will give you the net profit for the given year. -

2

Revenue refers to the income a company has generated through the sale of goods, products, services, or any other financial gain from an operating activity. This will also be termed as sales revenue or gross revenue.

-

3

Expenses will be the cash going out of the business, where assets are being consumed or liabilities are being paid up to deliver or produce the necessary goods, products or services. This will essentially include direct costs, which are referred to as Cost of Goods Sold (COGS). Material, direct labour, and overhead costs are also included as fixed expenses since they do not vary too much.

Non-operating expenses are not related directly to the core business, but are important on the management side. This will include interest expenses, loans etc. -

4

Subtracting all your expenses from revenue will provide us with the Pre-tax income. Now deduct taxes to compute your profit and loss statement. Essentially only large corporations show tax expenses on their P&L statement.

-

5

Typically a statement will look like this:

Revenues (Gross) xxx

Less Operating Expenses

Cost of Goods Sold (xxx)

Gross Profit xxx

Less Overhead Expenses

(Rent, Insurance, supplies) (xxx)

Less loan interest (xxx)

Earnings before Income Taxes xxx

Income Taxes (xxx)

Net Earnings xxx

Remember, Gross Profits and Earnings can also have negative values if the company is incurring losses.