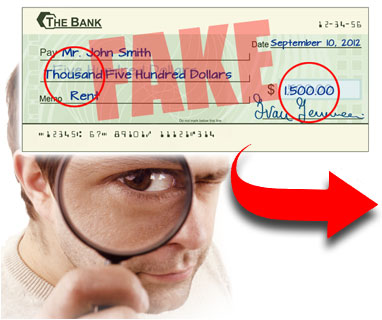

How to Prevent Check Fraud

In the business world, many frauds or scams are reported everyday and check fraud is one of the most common. Now the easy access to digital printing equipment has made it easy for con-artists to falsify any document and do check fraud. If you feel that someone has the potential to break through the system and put your stakes in danger then you should devise a counter strategy. Though, preventing a check fraud can be an uphill task but you can do it by following couple of simple directions.

Instructions

-

1

Have security features on your check:

The basic and most effective technique to protect yourself is to have specially designed checks. Almost all banks and financial institutions provide their account holders checks with special security features. If you find any loophole then contact your financial institution immediately and ask them to give you more secure checks. -

2

Keep your unused checks safe:

The most common mistake people make is that they do not keep their checkbook somewhere safe. Leaving your checkbook outside is just like tempting someone to withdraw as much money as one can. -

3

Do not sign your check in advance:

Another bad habit businessmen have is that they sign their check in advance to save time. Keeping a signed leaf in a checkbook is equal to giving a blank check to a cheater. You should not sign a check until you are standing in front of the bank cashier. -

4

Issue a cross check:

You should avoid making your check payable to cash as anyone can withdraw the amount if it is stolen or misplaced. The best way to avoid any unwanted situation is to issue a cross check. -

5

Do not give personal information:

Sometimes, a con-artist will ask you to provide personal information like a credit card number, social security number or EIN. Do not ever disclose this information as it can be easily misused. Keep in mind that all types of checks just require a valid account number, account title, amount and your signature. -

6

Call the bank if any check is missing:

If you feel that a check is missing then do not wait for another minute and call the bank to mark the check number. You can prevent fraud by cancelling the check bearing that number. -

7

Do not leave extra spaces:

Make sure that there are no unnecessary spaces in blocks mentioning “amount” or “pay to the order of.”