How to Read a Mutual Fund Prospectus

Investing money is an important and mature thing to do as it shows that you have positive plans for your future. Investing money in mutual funds is one thing but reading the slightly complex mutual fund prospectus is entirely different. You will find many different things in the mutual fund prospectus. Ranging from different funds to various investments, there are many different details which are very important to understand fully before you decide to invest money in a specific mutual fund. Reading a mutual fund prospectus in detail will also help you with a wide range of other investments.

Instructions

-

1

Get knowledge

Try to gather knowledge about mutual funds first. You should know why mutual funds are important and how they contribute to your investment. You should get information from all types of different sources to understand the use of mutual funds. Unlike other investments, many experts believe that mutual funds are a sound investment and will give your money positive growth. -

2

Check date on prospectus issue

You should check the date on the mutual fund prospectus. Sometimes the issuing date will tell you the exact time regarding little details of investing. You should understand that the majority of the mutual funds need to update at least once a year. You should always read the issuing date on the mutual funds prospectus. It is also important that while checking all the important details of the prospectus, you should also understand all the legal requirements. -

3

Read the narrative description

It is also important that you should read the narrative description of the fund. It is considered the least dry portion of the entire document. This portion of the prospectus will guide you to understand the objectives and goals of the fund and overall strategies of the investment. It will also guide you in better understanding the overall nature of the fund. -

4

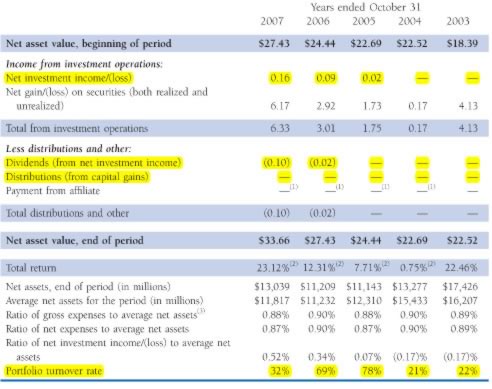

Read the fee table

This portion is also very important. The fee table is maintained for the management as how much they charge in expenses of fund management. -

5

Knowing risk table

Understanding the risk table is also very important. You should try to understand about the risks involved in the mutual fund. The risk table will help you understand all the little details of the mutual fund.