How to Reconcile a Credit Card Statement

Credit cards are one of the most common methods of payment all over the world. These are universally accepted and allow people avoid carrying large amounts of cash at all times.

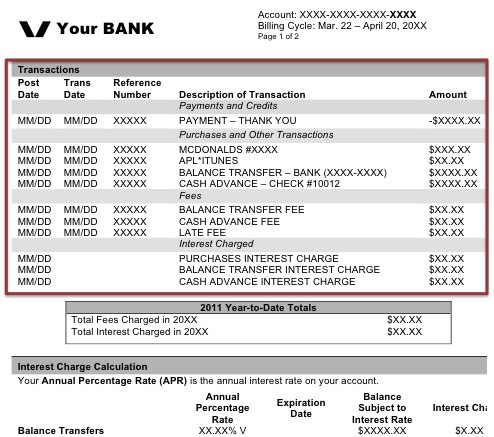

The payment of the credit card is due after the completion of each month. A statement, which can be in paper form or electronic form, is sent to the buyer who needs to settle it in a given amount of time.

It is important that a credit card statement is reconciled in order to make sure that no unauthorised charge shows up on the statement. The process is quite simple and can be done with relative ease.

Instructions

-

1

Keep the Receipts

Whenever you make a purchase on your credit card, make sure that you keep the receipt with you. Ideally, keep a small plastic bag in which you can put them. This is crucial as without these you will not be able to reconcile the statement. You can also keep them in record by scanning them and keeping them safe in form of a soft copy. -

2

Maintain a Log

Keep a log and make the entries for every transaction that takes place on your credit card. It is best that you make all the entries on the same day so that you do not miss anything. This will be greatly helpful particularly in case of you losing the receipts. -

3

Periodically Check Statement Online

Check the online statement every now and again in order to make sure that there is no unauthorised charge on your statement. This will keep you up to date and help in the final reconciliation of the statement at the end of the month. -

4

Print the Statement

If you receive it in mail, you obviously do not need to print it. However, if you have a paperless statement subscription, you can print the statement. When it is in printed form, it is a lot easier to reconcile the statement. -

5

Reconcile

Once you have the statement and the receipts together, you can reconcile them. Keep the log along with you and cross out the entries as you reconcile. Ideally do this with a pencil so that any alteration can be made in case it is needed.

If there is an expense that you did not make, immediately contact the credit card company and let them know about it, which is the main purpose of the reconciliation.