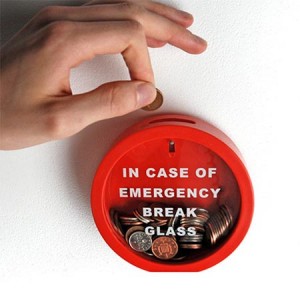

How to Start Saving an Emergency Fund

Instructions

-

1

Set a time frame and decide the amount

It is good to have a rough idea on the amount you need to save for an emergency situation. While there should be no limit to savings, it is important that you have enough in the locker to cover most of your expenses for a few months and give you security. This is an important consideration as it will help determine the money you can afford to save per month, week or on a daily basis.

You will be calculating the total expenses you incur during a month, and adjust it with the total income. What sort of expenses you can cut down, and how to do it are some questions you need ask yourself. For instance, if you want the saving accounts to cover three months of expenses, then decide the amount you can save each month. Set an achievable goal rather putting yourself in a financial tangle. -

2

Opening a Savings account

You will need a separate account where you can put all your savings. However, the emergency funds will be required immediately in case a problem arises, so it is important that you choose an option which allows greater flexibility. You can easily open a money market account as well. Most saving accounts will earn you interest, but will require you to maintain your deposit for a certain time period. -

3

Increase your savings

Find new ways to increase your savings. Save the change from your everyday transactions before depositing it into your savings account at the end of the month. Use a direct deposit option where money is automatically transferred to your savings account. Search around the house for any items which you no longer need or use. Try selling them for some money, and add it to your savings. If you get a bonus from your job, you can boost your savings with it as well.