How to Understand Basic Accounting Principles

Instructions

-

1

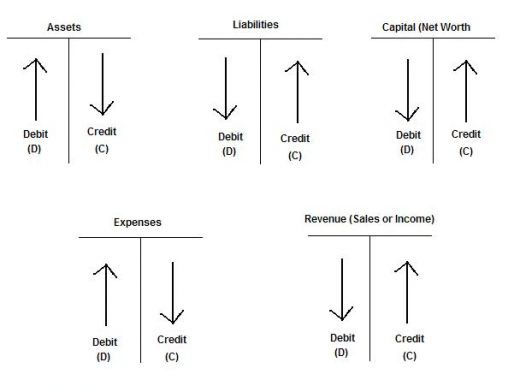

The fundamental accounting principle is simple, where a t-account is prepared to record a debit and credit entry. To record transactions, a general ledger is created which is a visual representation of the accounts. An accountant is usually hired for this purpose, who assigns a name to the T-account, where the left-side is referred to as the debit entry, while the right side is used to denote credit entries.

For instance, let’s suppose that a company buys inventory for $100. In order to record the transaction in the books, it will create two-accounts. One will be named purchases, and the other cash. It will then debit the purchase account to record an increase in the assets, while will off-set the balance by reducing the cash balance or crediting the cash account with the same amount. -

2

Let’s now look at the debit and credit entries. A debit entry increases the value of the account, if it carries normal debit balances. For instance if the company sells an item on credit, then accounts receivable will be debited with the amount, showing an increase. When the money is paid back by the customer, a credit entry is made to the same account which depicts a decrease in value.

-

3

Accounting Principles will follow a general rule that assets must equal liabilities and owners’ equity. This principle will apply across all accounting procedures where a company will create financial statements such as balance sheet, income statement and cash flow statements.

Assets will refer to those items owned by the company and will be used for production purposes. Liabilities are the obligations a company owes. The outstanding amount will be the profit generated by the company, usually referred to as the owners’ worth. That value can be negative as well. -

4

A few principles must be of great importance. Revenues must be recorded as soon as a transaction takes place rather than when the cash changes hand. Historical cost principle states that the actual value of an asset must be recorded rather than the current market value. Moreover, going concern principle expects the company to operate on a long term basis, allowing room for depreciation and amortization.