How to Write a Sales Invoice

A Business’ main aim is to make money. Revenue is only possible if they are able to sell their product or service. In order to monitor their inventory, cost, and ultimately profits, they need to prepare a sales invoice, which verifies that a sale has been made and the customer has received the bill. Moreover, it provides information about the product or products sold to a customer, the number of items sold (quantity), and the price of each unit. This basically confirms that a transaction has been made, and recorded in the books.

With advancements in technology, sales invoices are usually created through a customized software, which prints them out for the customers. However, this process takes a back seat when it involves small businesses, which rely on preparing the sales invoice manually in order to close the deal. If you belong to the latter category, then you might want to know the right way to write a sales invoice.

Instructions

-

1

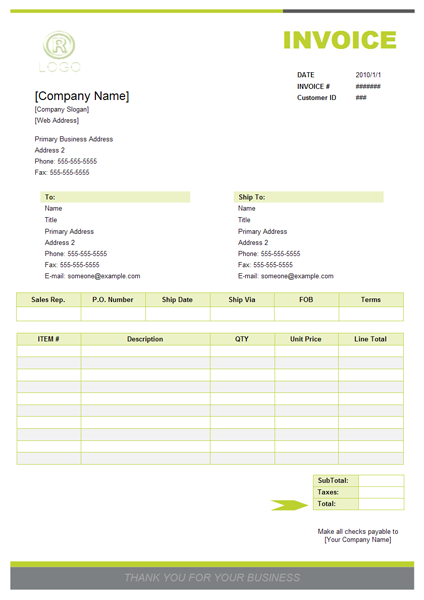

Begin by creating a heading or a letter head which verifies that it is you i.e. the company which has sold the product. The letter head can be prepared easily using Microsoft Word, where you double click on the top of the document and insert the name of the company, logo, business address and contact number.

-

2

You will then insert the invoice number for the transaction. This helps you differentiate every transaction you make. The can be placed on the top right corner of the invoice.

-

3

Add client’s details, such as name, account or order number, address and phone number.

-

4

Now add information related to the type of sale you have made. This will vary depending on the transaction. If you have sold only one product, then you will list the name of that product, the unit price, and the number of units sold. A coding system can be applied if you have assigned a particular code to a certain product. You can further add tables or columns and record each transaction accordingly. The final line must be left for the gross price of a particular transaction, and any discount or taxes associated with it. You can further list the payment method. If required, include the start and completion date.